- Is it difficult for foreigners to make credit cards?

- Necessary things when foreigners apply for a credit card

- Steps to get a credit card

- Bank accounts for foreigners

- Recommended credit cards for foreigners

- What are the reasons of being rejected in the examination?

- “VANDLE CARD”, a prepaid card without examination is also recommended for international students

- 【Article】Kindai University has a prepaid card on the student ID in a faculty with many international students!

Is it difficult for foreigners to make credit cards?

It seems difficult for foreigners to make credit cards in Japan, but it’s rather easy if you are a long-term resident.

Basically, the “residential status” and the “period of stay” are the main points when foreigners make credit cards.

If you are a mid- or long-term resident, you only need a “bank account” or a “residence” to apply for a credit card.

“What should I do if I don’t have either?”

Then, we recommend you to have a prepaid card called a “VANDLE CARD” that can be made without an examination.

You can use cash to charge the card at a convenience store.

Let me explain in detail later in this article.

■Read also:「What is a vandle card? Summary of how to make and how to use.」

Short-term residents cannot make credit cards

Only those who are planning to stay mid- or long-term can make credit cards.

Short-term residents (e.g. students for about 1 month) cannot make credit cards.

Why is it not allowed?

In July 2012, the alien registration was abolished and the new residency management system started.

Under this system, the “Residence Card” is not issued to short-term residents of 3 months or less.

The “Residence Card” is used as an identification card by foreigners who are staying in Japan for a mid- or long-term.

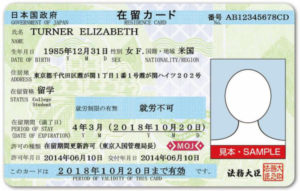

【Image of a residence card】

To make a credit card, it is basically required to have a bank account.

Because a residence card is required to open a bank account, foreigners without residence cards cannot open a bank account.

That’s why cannot make a credit card.

Why is the identification necessary?

Identification is required when opening a bank account in order to prevent money laundering*.

Financial institutions and credit card companies are required to verify users’ identities based on the “Act on Prevention of Transfer of Criminal Proceeds”.

*Money laundering: a mean of obscuring the source of money by transferring dirty money obtained by crimes or other acts to accounts with other’s names.

Issuing a credit card is easy if you are working

Most of you working in Japan should have some kinds of residential status (work visa), such as “technique” and “skill”.

If you have a work visa and a job in Japan, you should be able to easily prepare documents such as a “residence card” and a “residency certificate”.

In addition, you can easily clear the requirement: “Do you have a stable income?”, which is often asked in a credit card application.

It is relatively easy for foreigners working in Japan to apply for Japanese credit cards (aside from whether they will pass the examination).

Is part-time job necessary?

International students have a “study” visa, not a work visa.

However, if you have been granted for staying for 6 months or more with your study visa, you can work as a part-timer after applying for permission.

If you permitted, you can work basically within the range of “within 28 hours per week” or “within 8 hours per day during long holidays”.

In the case of a student card as described above, the income does not significantly affect the examination.

But if you have an income from a part-time job, it will surely help you pass the examination.

Necessary things when foreigners apply for a credit card

You are required various things according to the card company, but need “bank account” and “address” in any case.

【Items required when applying for a credit card in Japan】

- Bank account

- Address

- Mobile phone or fixed-line phone

- Residence card

- Special permanent resident certificate

The address should already be decided, so the question is the bank account.

To create a bank account, an “identification card” is essential as described above.

Be sure to check the main identification cards that are available.

Again, short-term residents can make neither a bank account nor a credit card.

Residence card

(left:Front,right:Back)

The most common way that foreigners prove their identity in Japan is a residence card.

Because the residence cards indicate the residential status and the period of stay as well as basic information such as name and address,

it is the most used identification for foreigners.

>>See the website of the “Ministry of Justice – Immigration Bureau” for details on residence cards (supporting 26 languages).

Special permanent resident certificate

(left:Front,right:Back)

The Special Permanent Resident Certificate is a residential status recognized by the law enacted on November 1, 1991, entitled “Special Act on the Immigration Control of, Inter Alia, Those Who Have Lost Japanese Nationality Pursuant to the Treaty of Peace with Japan”.

When the Japanese territories became independent after World War II, the Japanese who had emigrated to those countries lost Japanese nationality.

Therefore, a law was established in 1991 to recognize the residential status of the former Japanese, and a special permanent resident certificate was issued to those eligible.

You cannot get a special permanent resident certificate by applying for it.

Those who have a special permanent resident certificate often use it as an identification card.

>>See “What is a special permanent resident certificate? (Immigration Services Agency of Japan)” for details on residence cards.

Steps to get a credit card

Now that you know that mid- or long-term residents can apply for a credit card, let’s take a look at the steps of application.

【Steps to get a credit card】

- Obtain a residence card

- Open a bank account

- Submit an application

Make sure to apply with following these 3 steps.

Bank accounts for foreigners

Credit card payments are withdrawn from your bank account.

Let’s create a bank account first, as it’s required upon applications for credit cards.

Point 1: Use residence card for identification

The websites of some banks state that passports are also accepted as identification cards.

However, it is best to bring your residence card because the period of stay may be required to confirm.

If the period of stay (until the expiration date) remains less than 3 months, you may not be able to open an account.

Point 2: Use your real name

It is common practice to open a bank account with a real name, not with a business name or other common name.

Even foreigners should register with names in the native language.

Sumitomo Mitsui Banking Corporation

![]()

Q: I’m a foreign national. Can I open an account?

A: Non-Japanese nationals can also open an account.

Source: Sumitomo Mitsui Banking Corporation – Frequently Asked Questions

Mizuho Bank

![]()

Q: I’m a foreign national. What procedures should I take in order to open an account?

A: Customers who do not have Japanese nationality can open an account.

Based on laws and regulations(*), identification documents (e.g. passport, residence card) are required when opening an account.

*Act on Prevention of Transfer of Criminal Proceeds

MUFG Bank

There was no FAQ page regarding the account opening for foreigners on the website of MUFJ Bank,

but it is presumed to be possible to open an account because the residence card is considered as an identification card.

Recommended credit cards for foreigners

Once you opened a bank account, you just need to submit an application for a credit card.

All application screens and application documents should basically be filled in Japanese.

It is recommended that you work with your colleague if you’re working, or the support center if you’re an international student.

The application screen is not designed for foreigners.

You should answer as much as possible to pass the examination, so it’s a good idea to ask the credit card company in advance if you have any questions.

JCB CARD W 【For ages 18 – 39】

“JCB CARD W” is issued by JCB, which is Japan’s only international brand.

This is also an excellent card with no annual fees and with 1.0% point return rate.

In addition, you can earn more points at some shops such as Seven-Eleven and Starbucks, which are popular among students!

Application documents for JCB CARD W

- Japanese bank account

- Address in Japan where you can receive your card

- Phone number in Japan that you can be contacted

*an account supports payment via Internet and with your real name

*Confirmed by contacting JCB in December 2019

Identification documents are not required for the application of the JCB CARD W as well.

>>Check here (official website) for accounts supporting payment via the Internet.

What are the reasons of being rejected in the examination?

The reasons why foreigners are rejected are mostly the same reasons as in the case of Japanese, such as:

- Incomplete application information

- Multiple applications

- Demand for cashing allowance

Avoid mistakes in application information!

You need to fill in various information such as name and address upon application for a credit card. Be careful not to make any mistakes.

For example, it is better to apply with your real name, otherwise the name will be different from that described in official documents.

Do not apply for multiple cards at the same time!

The application history for credit cards is stored at the personal credit bureau for 6 months.

Credit card companies check the information registered with this institution at the time of examination.

If you have submitted many applications in a short period of time,

the credit card company thinks “you have trouble with money” and is likely to reject your examination.

Do not apply for multiple credit cards at the same time and wait patiently for the examination results one by one.

Do not demand for cashing allowance! (set to 0 yen)

You can request a cashing allowance (a function that allows you to borrow money at an ATM) when applying for a credit card.

However, because you are a student and in consideration of the period of stay,

you will be easier to pass the examination by avoiding the cashing allowance.

Similarly, it is easier to pass the examination if you apply for a small amount of shopping allowance.

“VANDLE CARD”, a prepaid card without examination is also recommended for international students

If you are unable to apply for a credit card or have rejected in the examination, we recommend you to apply for a prepaid “VANDLE CARD”.

【Advantages of VANDLE CARD】

- Rechargeable prepaid card

- No examinations

- No age restrictions

- Can be used at VISA-affiliated shops inside/outside Japan

- Internet-only cards can be used immediately after an in-app registration

VANDLE CARD is a prepaid card issued by VISA that anyone can use without examinations or age restrictions.

You can choose from 3 types: “Virtual card” for Internet-only, “Real card” for both online and offline, and “Real +” as a higher version of the real card.

If you want to use the virtual card for Internet-only, all you need before use is just an in-app registration.

■Read also:What is a vandle card? Summary of how to make and how to use.

Charge with cash like a credit card

Because the VANDLE CARD is a VISA brand, it can be used at VISA-affiliated shops all around the world.

- Monthly charge: 120,000 yen

- Amount per charge: 30,000 yen

- Total maximum charge: 1,000,000 yen

- Maximum balance: 100,000 yen

It’s also easy to use, just specify the charge amount you want within the limit.

Once the charge is completed, you can use it the same as a credit card.

In addition, the Real + card is recommended for those who use the card frequently as it has a higher charge amount: “monthly charge: 2 million yen” and “amount per charge: 100,000 yen”.

Some foreigners have already registered as members! (confirmed to head office)

It is confirmed with the head office that they have foreign residents and international students as members of VANDLE CARD.

It is a good option applying for a VANDLE CARD if you cannot make a credit card because of a short period of stay.

Although it’s a prepaid card, it has a big advantage when you want to make a cashless payment.

【Article】Kindai University has a prepaid card on the student ID in a faculty with many international students!

I found a good example for international students coming to Japan.

There is a university that issues a student ID with a prepaid card function!

Kindai University has a student ID with the function of a prepaid card.

- Rechargeable VISA prepaid card

- Earn 1 point for every 2,000 yen payment

- No examinations

- No annual membership fees

- Can be used at VISA-affiliated shops

Because it is a VISA prepaid card, it can be used at various VISA-affiliated shops both online and offline, and there are no examinations or annual membership fees.

It is also attractive that you can earn points like a credit card depending on the paid amount.

The card is convenient as it’s integrated with the student ID.

International students have also an option utilizing such prepaid cards.

Source of images

学生クレカ管理人

自分が大学生・未成年時代のお金・クレジットカードの失敗経験をもとに、同じ失敗をする人・クレジットカードについて悩む人をひとりでも減らしたいという気持ちで当サイト運しているクレジットカードの専門家。

130枚以上のクレジットカードを比較検討し、累計22枚のカードを所有してきました!(大学生の頃は6枚所有)

航空券をほぼ無料にし、ふらっと旅行に出かけるのが趣味で、Amazonでのお買い物も累計40万円分以上、ほぼポイントで済ませています。

カード会社幹部や広報部・外部の専門家ともつながりがあり、常により良い情報を届けられるように頑張っています!

▼ブログランキングにも参加しております。 当サイトの思想に共感いただける方は、ポチッとおねがいします(タップ1回で投票完了します)

自分にピッタリのクレジットカードの選び方がわからない方は、基礎知識・おすすめカードの選び方が一気に学べるトップページをぜひ見てください。→ 学生クレジットカード.com

コメント